If you are a non-U.S. resident (not a U.S. citizen and not a U.S. green card holder), you can sell on the Amazon U.S. marketplace without paying any tax to the United States. How? By setting up a single-member LLC in the USA.

Why Non-US Entrepreuers Should Set Up Single-Member LLC in the USA

- If you can pay zero tax legally, then you have a cost advantage over your competitors on Amazon, and this is very important for business success.

- Moreover, the United States doesn’t participate in the CRS (Common Reporting Standard), so if you open a bank account in the U.S, your financial information won’t be reported to your home country.

- USA customers are more likely to buy products from USA companies.

- USA LLC is very cheap to set up and maintain. The setup cost is about $150. No lawyer is required. No need to have an audit of financial statements every year.

- It enables you to access great banking & payment processing options provided for U.S companies.

- Good privacy. Some states in the USA like Wyoming and Delaware don’t require an LLC owner or manager to be listed on the Articles of Organization. This prevents random people from finding out that you are the owner of your LLC.

- You can set up USA LLC and open a business bank account online, without ever traveling to the USA.

How to Avoid Paying Tax in the USA Legally

As a foreigner (not a U.S. citizen and not a U.S. green card holder), you can avoid paying taxes in the USA by setting up a single-member LLC.

By default, a single-member LLC in the United States is considered a disregarded entity for income tax purposes, which means all of the LLC’s income is treated as the owner’s personal income, so the tax liability is transferred to the individual owner. The IRS (Internal Revenue Service ), which is the tax agency of the United States, doesn’t tax the LLC but taxes personal income distributed from the LLC.

You, as a non-US resident, will be the LLC’s owner. And there are many situations that the IRS doesn’t tax non-US residents. The IRS taxes non-US residents only when they have effectively connected income (ECI) in the U.S.

If you don’t have ECI in the U.S, then you don’t pay tax. According to the current US law, non-US residents participating in the following activities don’t have ECI in the U.S, so they don’t need to pay taxes in the United States.

- eCommerce: Amazon FBA Sellers and Shopify dropshippers.

- Stock trading: If you are a foreigner trading stocks on the USA market, you don’t need to pay capital gains tax. However, dividend is considered USA-source income and the broker withholds 30% for tax.

- Cryptocurrency Trading

- Affiliate Marketing

- Freelancers and people who provide services online from outside of the United States.

Beware that this doesn’t apply to:

- Website owners who earn Adsense income from the USA.

- Youtubers earning Adsense income from the USA.

Before July 2021, Adsense income was classified as nonemployee compensation and non-US Adsense publishers don’t need to pay tax to IRS. However, starting with July 2021, Google classifies AdSense income as royalty income. And any US-source royalty income is subject to 30% withhold tax. If you have Adsense income from the United States, 30% of Adsense income is going to be withheld by Google. If you have both Adsense income and Amazon FBA income in the USA, only the AdSense income is going to be taxed. Amazon FBA income is still tax-free.

Do you already own a single-member LLC in the USA and have paid tax to the United States? You can request a refund from the IRS.

Do you need to pay tax if you have bank accounts in the US? No. There are a number of court cases from prior years that blatantly say in the rulings that having a USA bank account and US company is not sufficient to be having a trade or business in the United States.

Things You Should Not Do to Avoid Paying Tax

In order to keep your tax-free status, there are several things you should not do.

- Don’t hire a USA worker. If a U.S. person or entity works exclusively for your company, then they are your dependent agent, and you will pay taxes in the U.S. Moreover, U.S workers are more expensive when you can just hire freelancers all over the world.

- Don’t rent or buy a USA warehouse, office, etc. Don’t own any equipment in the U.S. If you need to ship products to customers, use a third-party fulfillment service like FBA.

- Don’t ever travel to the United States. The IRS says: “You are considered to be engaged in a trade or business in the United States if you are temporarily present in the United States as a nonimmigrant on an “F,” “J,” “M,” or “Q” visa. ” You certainly should not work in the United States if you want to avoid paying tax.

- Don’t buy web servers in the U.S. U.S. Activities include, but are not limited to, owning a web server or owning a hosting service in the U.S., or having employees in the U.S. who are involved in either.

How Much Does it Cost to Set Up a US LLC?

It’s not expensive. Actually, it’s very affordable to form an LLC In the United States compared to some other countries in the world. The setup cost is about $150, and the annual renewal fee is about the same amount.

Moreover, private companies like single-member LLC don’t need to perform annual audit of financial statements in the United States, saving you time and money every year. An audit is only required for publicly-traded company (companies that issue stocks on the market).

LLC Company Initial Setup Fees in the United States

This is how much you are going to spend in the first year for company setup.

- virtual mailbox service: $9.99/month

- USPS Form 1583 Notary Fee: $65 (one-time)

- LLC filing fees: one-time $150 or $199 if you want your company to be set up in two days.

- Registered Agent Fee: Free for the first year.

Company Annual Fee

This is how much you are going to spend annually starting with the second year.

- virtual mailbox service: $9.99/month

- Company Renewal fee: $150/year

- Annual Report: $60/year

- Registered Agent fee: $99/year

Now let’s learn how to set up a single-member LLC in the United States step by step. All of this can be done online. Please follow the steps to the letter. I don’t guarantee your success if you don’t follow my advice.

Required Documents to Open LLC

You need to prepare two forms of ID. The following is acceptable.

- Passport

- National ID card

- Driver’s license

For example, I didn’t have a passport at the time when I try to open my LLC, but I can use my national ID card and driver’s license in the LLC setup process.

LLC Setup Process

- Choose a state to form your LLC

- Get a physical mailing address

- Use a legal service company to form your LLC

- Obtain the company documents

- Make an operating agreement for your LLC

- Get EIN (Employer Identification Number) for your LLC

- Open business bank account

- Organize all your company documents

- Get a USA phone number

- Fund your company

Step 1: Choose A State to Form Your LLC

There are 50 states in the US. Which state to open your LLC?

While you can open LLC in any state and pay no tax, there are other factors you should consider. Here are the 4 popular choices for non-U.S. residents.

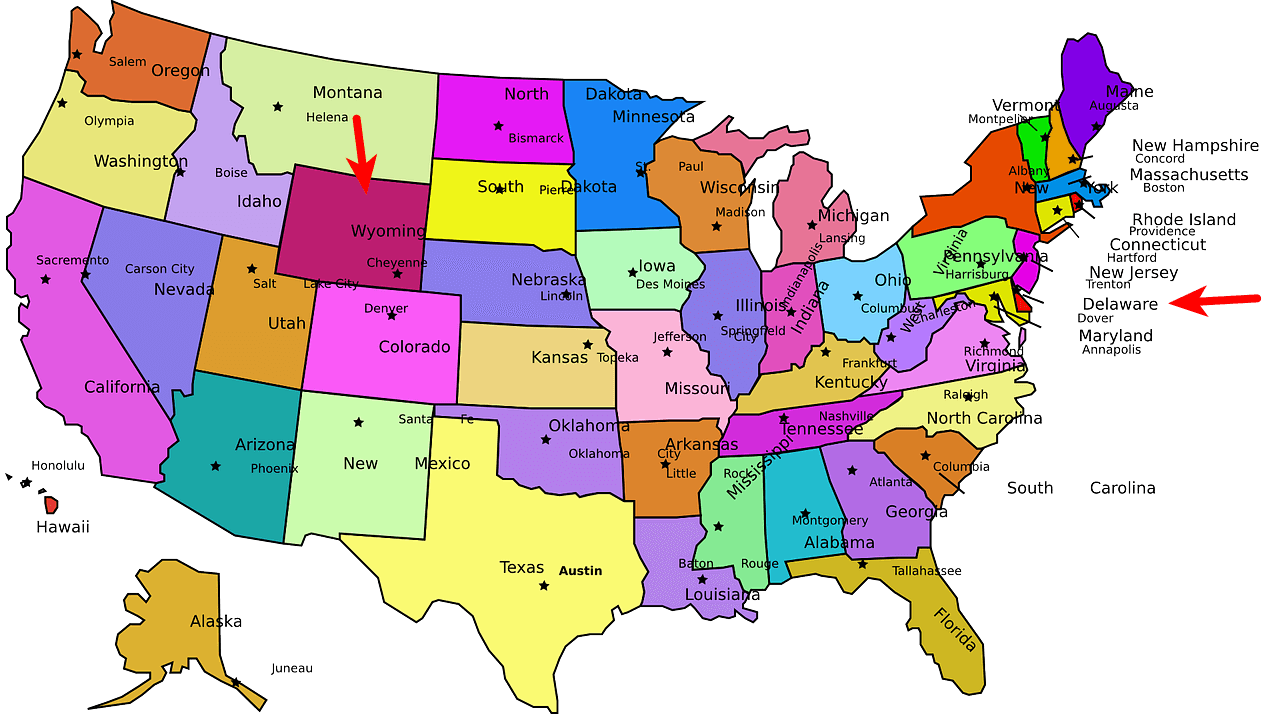

- Delaware

- Wyoming

- Nevada

- New Mexico

These are the LLC-Friendly States. They all provide excellent privacy for the LLC owner. The state doesn’t know who the owner is. You have a third-party legal service to open the LLC on your behalf. There are 8 U.S. states, including Delaware, Wyoming, Nevada, and New Mexico, that don’t require LLC founders to disclose the identities of their managers or members, so a random person can’t look upon the Internet who is the owner of your LLC. If you open LLC in other states, anyone can look up who the LLC owner is.

So you know the LLC-friendly states. What are the most LLC-Unfriendly states? Well, they are:

- California

- New York

- Arizona

- Nebraska

There are 3 states (New York, Arizona, Nebraska) that still have publication requirements. That is, newly-formed Limited Liability Companies (LLCs, PLLCs, LPs, and LLPs) must publish an announcement of their formation in two local newspapers once a week for six weeks in a row. That can cost you $600-$1200. So avoid these LLC-Unfriendly states.

In which states should you form your LLC? My personal recommendation: Wyoming or Delaware.

I formed my company in Wyoming because it’s cheaper in the long run. Some of the most attractive features of Wymoing LLC are anonymity and charging order protection, which can protect your assets from creditors, divorce, and lawsuits.

Wyoming

Wyoming is the state that invented the LLC company structure and it continues to provide more benefits for LLC owners. It’s known as the most business-friendly state in the U.S.

- A very minimal annual fee. cheaper costs in the long run, The initial filing fee is $100 and the annual fee for maintaining an LLC is typically around $50

- Anonymous LLC. does not have requirements for listing members to the state. Wyoming’s Secretary of State does not require an LLC owner or manager to be listed on the Articles of Organization.

- no personal income tax

- no corporate income tax

- No intangible tax. Wyoming does not tax intangible assets such as stocks and bonds.

- No exercise tax

- No estate tax

- Wyoming doesn’t share financial records with outside agencies. Wyoming doesn’t have an information-sharing agreement with the IRS.

- Bitcoin-friendly, blockchain friendly.

- Charging order protection. Your personal creditor can’t seize your company assets.

- Flexible management. You don’t need to be an owner or member of the LLC to have 100% of management control.

- Flexible profit distribution options.

Delaware

- does not have requirements for listing members or revealing stockholder information to the state. So random people can’t find online that you are the owner of your company. Delaware’s Secretary of State does not require an LLC owner or manager to be listed on the Articles of Organization.

- Simple to form LLC. No passport or driver’s license is required.

- Court of Chancery. If there’s a lawsuit against your company in Delaware, the outcome will be decided by judges, instead of juries.

- no personal income tax

- Investors love Delaware company. If your company needs to raise capitabl, set up a Delaware company.

- CRS non-compliant

- $300 annual renewal fee.

Cons: It’s on the blacklist of some countries.

Step 2: Get a Physical Mailing Address in the US

Each LLC needs a physical mailing address, also known as a business address, which can be anywhere in the world. You need to provide this address in various forms.

- When you form your company, the state requires you to provide your mailing address in the Article of Organization.

- The IRS (Internal Revenue Service) needs to know your business address.

- Banks need to know your business address in order to open a bank account for your company.

- If you use email marketing, you need to include your mailing address in the email message to comply with United States law.

You should not use the following address as your business mailing address.

- Your registered agent’s address

- Your home address

- A P.O. box (post office box)

I will explain.

Some folks use the registered agent’s address as the mailing address. That can work, because the secretary of state doesn’t do address validation, but there are two problems.

- If your LLC gets sued, the plaintiff’s attorney can pierce the corporate veil, because you don’t really own the registered agent’s address. So your personal assets are at risk.

- The registered agent doesn’t forward all mails if you don’t pay them extra money to do this work. By default, the registered agent will only provide service of process to you. For example, they will inform you if you are sued. If you receive a business credit card at your mailing address, your registered agent will not forward it to you.

It’s also not a good idea to use your real physical address (home address) as the mailing address, because

- This will let other people find out that you are the owner of the LLC and they can find you when they need to.

- It’s harder for you to open a business bank account if you don’t have a physical mailing address in the United States.

The physical mailing address needs to be a street address. Don’t use a P.O. box.

- Some states don’t allow you to use a P.O. box.

- If you use a P.O. box, then you might have difficulty when trying to get EIN from the IRS.

- A P.O. box gives a bad impression to your customers.

So what you can use as your business address? A common and good option is to use a virtual mailbox service like anytime mailbox to get a physical street address in the United States.

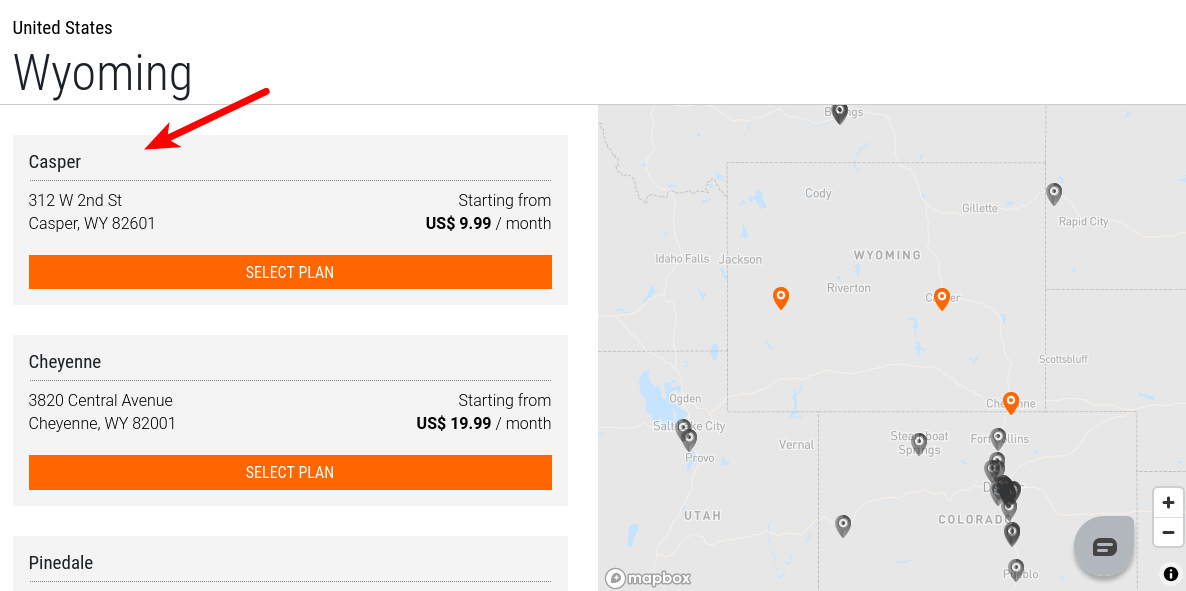

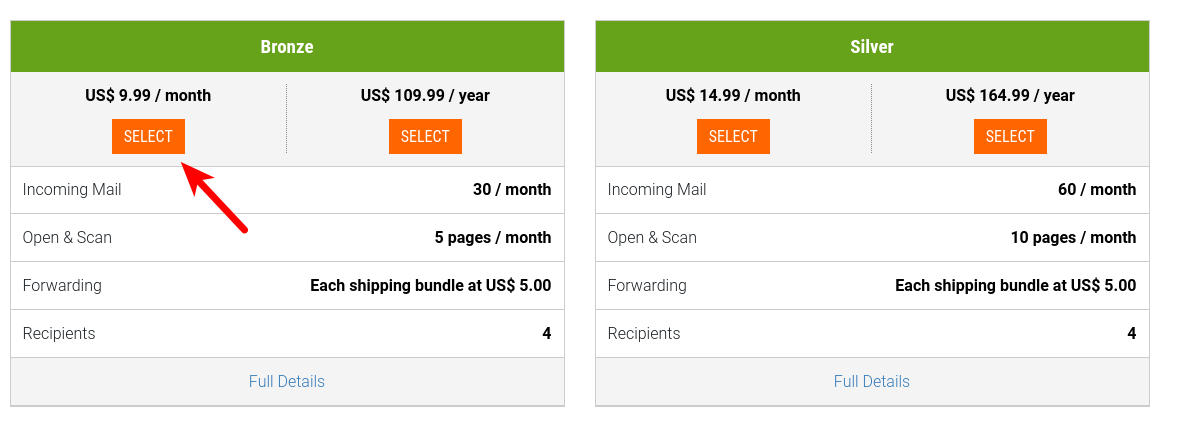

- It costs only $9.99 per month. The price can go up if you choose a premium vanity address, but the most common price is $9.99/month.

- They will give you a credible-looking street address and collects all mails for you.

- You can view mails online. They can scan the outside envelope and if you decide that this mail should be opened, then they will scan the inside. You can also tell them to shred the mail if it’s junk mail.

- If the mail needs to be forwarded to your home, they can also do it for you. For example, when your bank sends a business credit card to your mailing address, anytime mailbox can forward it to your home address. It can deliver the mail/package to any location in the world.

Since I want to form my LLC in Wyoming, so I choose a mailing address in the Casper city of Wyoming, which costs $9.99/month. If you choose Cheyenne city in Wyoming, it costs $19.99/month, because it’s the capital city of Wyoming. Go to this page to select the Casper, Wyoming plan.

On the next page, Anytime Mailbox will try to sell you premium features like check deposits. We just need the basic features, so select the Bronze $9.99/month plan. The check deposits service allows you to receive check payment and it will be automatically deposited to your bank account. But when did you receive a check payment? I have never received a check during my entire online business adventure.

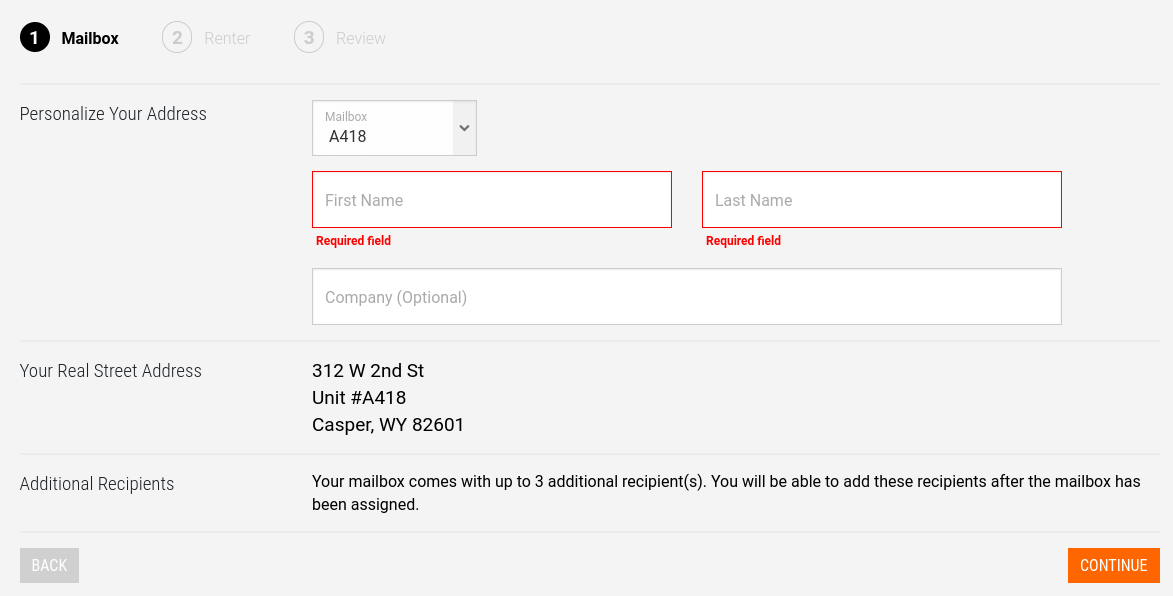

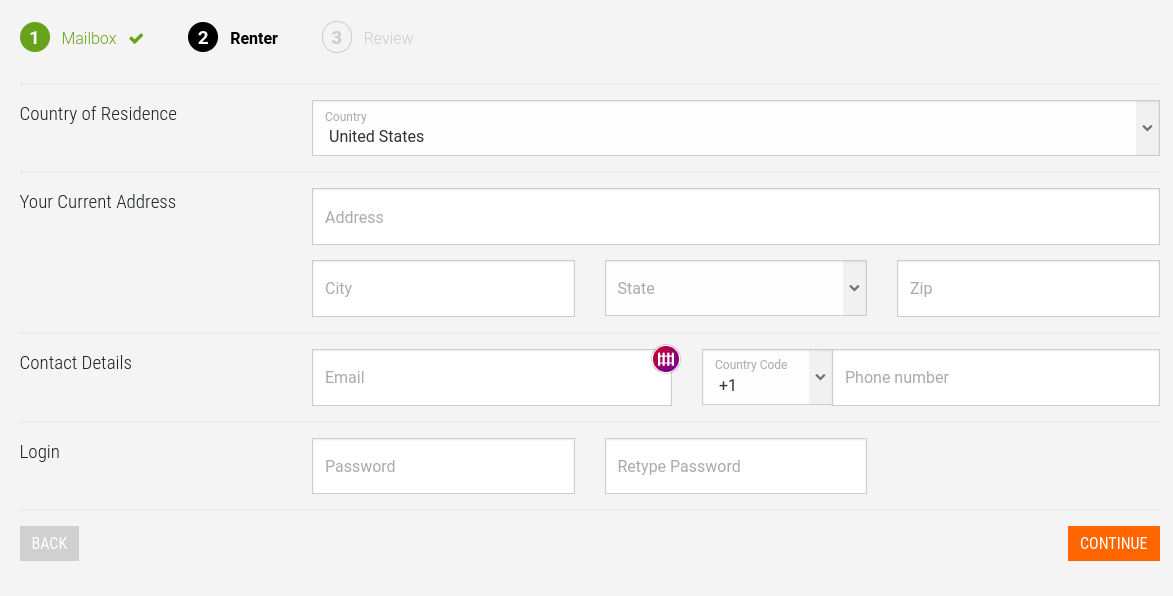

On the next page, you will need to enter the recipient’s name for your address. Your name won’t appear in the address.

Next, enter your real home address and phone number. This information is only used between Anytime Mailbox and yourself. It’s not going to be public. If your mother tongue is not English, then I recommend entering the Address field in your own language. You can also enter two addresses: one is in English, another in your own language.

Then enter your credit card number to complete the sign-up process.

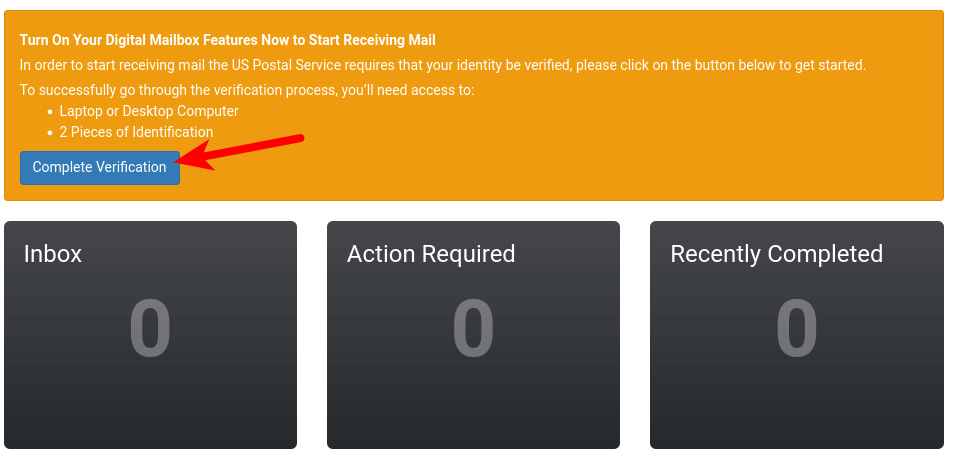

Once that’s done, you can log into your Anytime Mailbox account. You need to accept the terms & conditions in order to use the service.

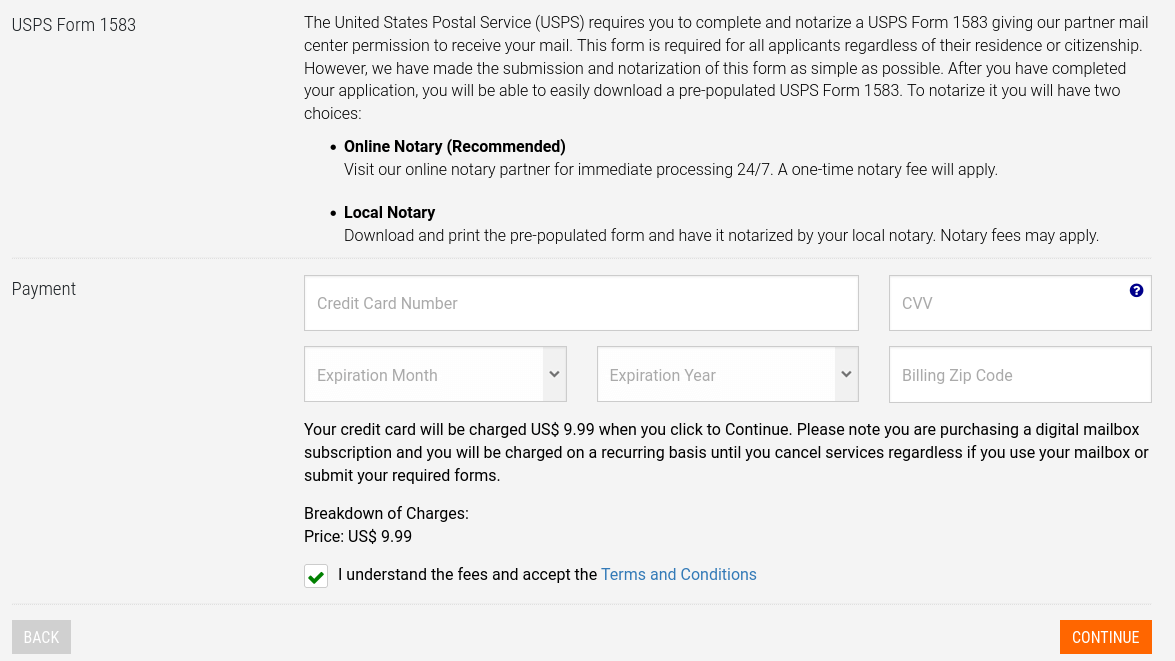

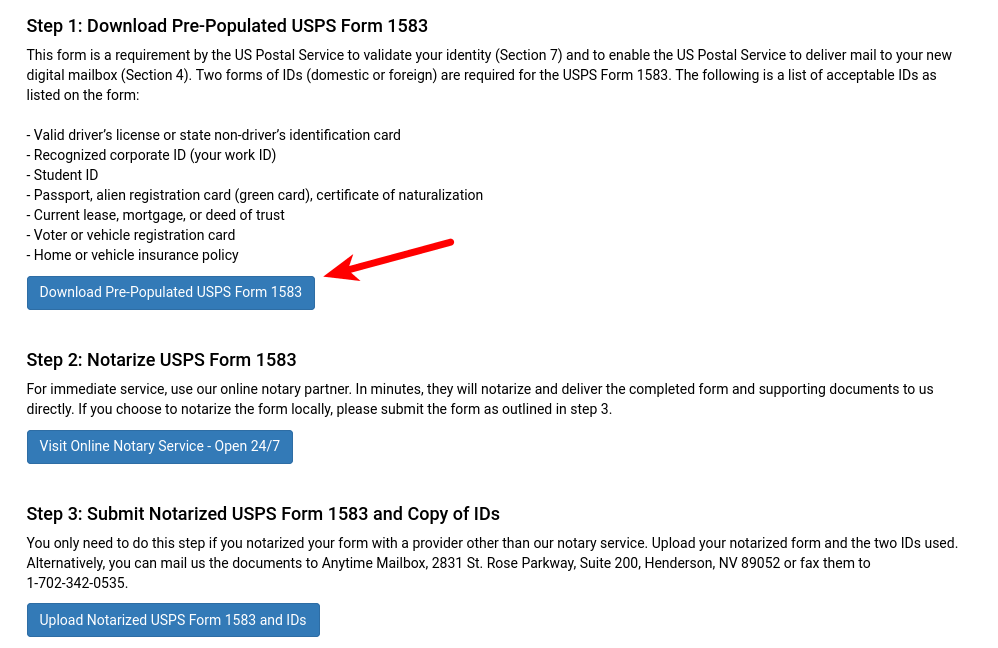

Next, you need to fill out the USPS form 1583, which is used to certify that you authorize Anytime Mailbox to manage mail delivery for you in the United States. This is required by United States Postal Service, no matter where you live in the world. U.S. Citizens also need to complete this form.

In your Anytime Mailbox account dashboard, click the complete verification button.

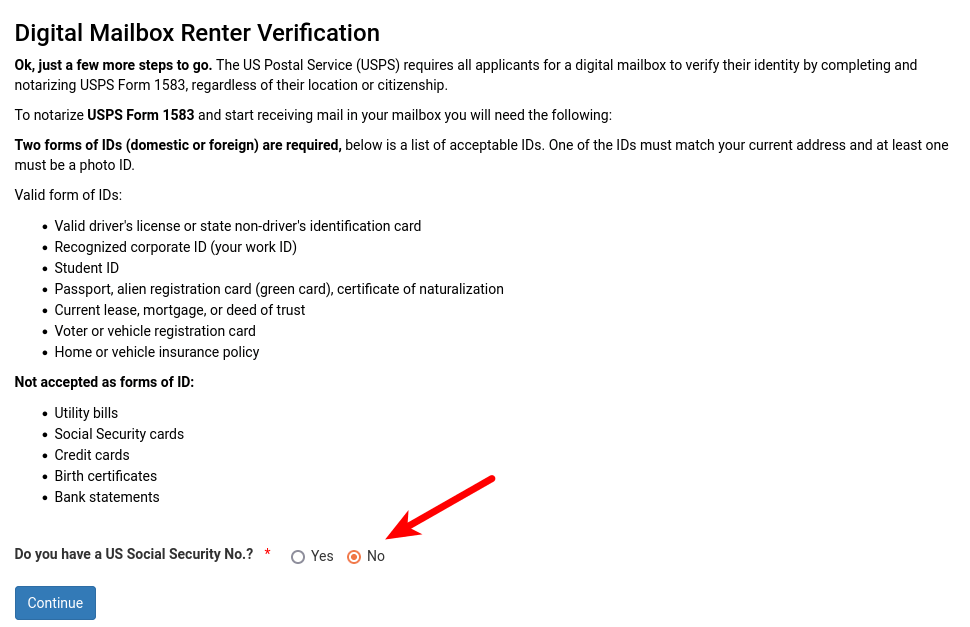

Since you are not a U.S. citizen/resident, it’s likely that you don’t have a US social security number.

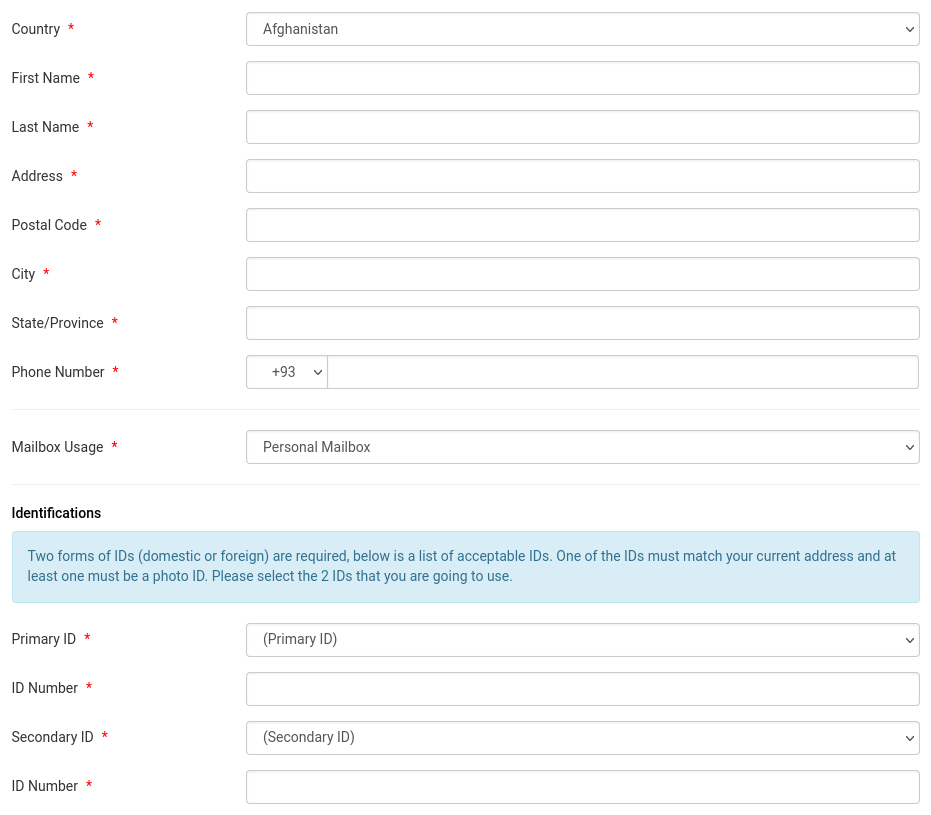

On the next page, you need to enter personal details as it appears on your ID. Don’t enter any false information here. You will also need to enter your ID number.

Once that’s done, click the Use own notary button. You will be taken to a web page where you can download a pre-populated USPS form 1583.

Here’s how to fill out USPS form 1583. It’s a PDF document, so you need to use a PDF editor like Sejda PDF to fill it out.

- Box #1: The current date such as

November 11, 2021. - Box #2: This is the name of who the mail will be sent to and can also be your doing business name

- Box #3: Your business address in the United States, which is the address you selected when creating an account at Anytime Mailbox.

- Box #4: (a) the name of the CMRA (b) Your business address in the United States

- Box #5: Sign here if you want Anytime Mailbox to receive restricted-delivery mail on your behalf. It’s highly recommended to add your signature here.

- Box #6: Type the name exactly the same as the person or business name who will be receiving mail.

- Box #7: Your home address as appeared on your identity documents (Passport, government ID card, driver’s license).

- Box #8: Two pieces of your identity documents.

- Box #16: Your signature.

Since the form is pre-populated, all left to do is to use Sejda PDF editor to add an eSignature on Box #5 and #16. You also need to scan or take a clear photo of your two IDs.

Now you need to use a notary service to get your USPS form 1583 notarized. Anytime Mailbox partners with notarize.com to get you notarized. It’s available 24/7, so you can choose to use it.

You can also use other online notary public services. For example, I hired a notary public on fiverr. It’s quick and easy. As you can see from the screenshot below, this Fiverr seller has 278 5-star reviews.

If the notary public doesn’t support your language, you can use a translation service like RushTranslate, which offers certified translation, so that your identity documents (passport, government ID card, driver’s license) can be used by universities, courts, and many local, state, federal governments, and other legal situations.

Then I uploaded my notarized USPS form 1583 and two translated IDs to Anytime Mailbox. Next, wait for Anytime Mailbox to review your notarization. Once it’s approved and you have a street address in the United States, proceed to step 3 to create your LLC.

Note: Actually you can proceed to step 3 while your notarization is being reviewed because the secretary of state doesn’t do address validation, they accept any U.S. address in the Article of Organization.

Step 3: Use a Legal Service Company to Create the LLC

You don’t need to go to the United States and you don’t need to hire a lawyer. You will need a legal service company to help you form the company online with reasonable fees, which is much lower than a traditional lawyer. A legal service company helps its customers create legal documents, in this case, the company formation documents.

Can you open a USA LLC if you are under 18 years old? Yes, you can. You don’t need to provide any identity documents to form an LLC. Only a U.S. Mailing address is needed, which you get from Anytime Mailbox.

Can you form a US LLC without a legal service company and do it yourself? Yes, but you should not form a U.S company by yourself. It’s a really troublesome process. If you choose to do it yourself, you will probably need to go to the United States, which costs money. And it’s very likely you will do something wrong. You need a registered agent, prepare the article of organization, and other stuff for your company and the legal services can help do that, so you don’t need to worry too much about it. The legal service company will be your registered agent and organizer of your company. They prepare all the paperwork to open your bank account, so you don’t need to go to the United States to open a bank account.

It’s actually much cheaper for you to use a legal service company. There are many well-known legal service companies in the United States, such as

- Incfile

- IncAuthority

- www.blumberg.com

- legalzoom

- incorporate

- rocketlawyer

- zenbusiness.com

I tried IncAuthority before, but the experience was pretty bad. I ask them to form an anonymous LLC in Wyoming and they said my name will not be included in the Articles of Organization, but when I received the company documents, I saw my name was used as the organizer for my LLC in the Articles of Organization, so my profile is public! If you call customer support for a refund, they will tell you that they don’t deal with refund.

Later I use Incfile, and the experience is very good. I like Incfile because

- Price is much lower than its competitors

- Your name and address will not be included in the Article of Organization to protect your privacy. Incfile will be the registered agent and organizer if your form LLC in Wyoming.

- Very fast business setup. I paid an extra $50 for expedited LLC filing and my LLC was formed the next day.

- You can choose a person or company as a member of the LLC.

- Supports holding company setup

- Company formation documents will be sent to you electronically.

- They will try to upsell you some stuff, but the upsell is minimal compared to IncAuthority.

When creating the LLC on Incfile website, make sure that

- The LLC is a single-member LLC.

- Don’t elect to S-Corp. Stay as a disregarded entity.

- Your name and home address won’t appear in the article of organization.

- Determine How the LLC will be Managed. An LLC can be member-managed or manager-managed. By default, an LLC is member-managed.

When you provide Members Information during the signup process, Incfile will tell you that “The articles of organization will not record the names and or addresses of the initial members of the LLC.” So your LLC is anonymous.

You can choose to buy other services in the signup process. For example,

- I chose fast company setup in one day ($50). I really got my LLC formed the next business day.

- For the operating agreement, I choose to do it by myself, because I can find templates online.

- Don’t have them obtain EIN for you. It’s very slow. Instead, you can use an EIN fast-track service on Fivver to get your EIN in 3 days.

- Don’t use Bank of America to open your business bank account, because you are required to have a physical residence in the U.S. to open a small business bank account with them. Since you are a non-resident alien, you don’t meet this requirement. I will show you how to open business bank account with Mercury later.

- Select Electronic delivery so you will have instant access to your company documents after the LLC is formed. You can always have them deliver the original documents later. Actually there’s really no original document because they file your LLC online and they get an electronic file from the state.

- You can choose free business tax consultation.

- For Business Licenses and Permits, choose No. because you don’t need that for your online business.

On the order review page, make sure your LLC name is correct and your LLC will be formed in Wyoming.

The Registered Agent of Your LLC

A registered agent is an individual or entity that has been appointed by an LLC or Corporation to receive service of legal documents and notifications from the state. For example, if somebody sues your company, your registered agent will notify you about it.

A registered agent must have a physical address in the state. It can’t be a P.O box.

If you want to have an anonymous LLC, you should not choose yourself as the registered agent. And since you are a non-USA resident, you can’t be the registered agent. Incfile will be your registered agent. This service is offered for free for one year.

The Articles of Organization

Incfile will file the article of organization for you, so you don’t need to do it yourself.

Content of the articles of organization

- The name of the organizer

- Who is the registered agent

- Business address

You should not choose yourself as the registered agent, because that will reveal who is the real owner of your LLC. Moreover, since you are a non-USA resident, you can’t be the registered agent. Use a legal service as your registered agent.

Make sure the article of organization doesn’t list your name. You need to use a third party as the organizer. If it says you are the organizer, then the anonymity of the company doesn’t exist.

It also shouldn’t include your real address. You can use a mail forwarding service like AnytimeMailbox to rent a physical address as the business address. Don’t use your real address as the business address, or other people can look up who live at your address and so they can find you are the owner of your LLC.

The article of organization is also known as certificate of formation in some states.

Step 4: Obtain the Company Documents

You will receive the following two documents from Incfile:

- Article of Organization (signed by Sectary of State). This is a legal document telling that your LLC is formed with the Sectary of State. The information on this document is public. Incfile is the organizer. Make sure it doesn’t include your name and your real address, and you are not the registered agent.

- Statement of Organizer (Signed by the Organizer). This is a legal document that transfers the management of the LLC from the organizer to you and appoints you to be the initial member of the LLC. It’s an internal document, not available in the public records. It relinquishes the rights and duties of the organizer to the initial member of the LLC. Although it’s not legally required, you should ask your organizer to notarize this document.

You can download the two documents in PDF in your Incfile account dashboard.

Once you have formed your LLC, go to Wyoming Sectary of State website and do a business entity search. You will find that incfile is your organizer, and there won’t be any of your information in the search results.

Step 5: Make an Operating Agreement

An operating agreement deals with matters of internal procedure and is usually considered to be a contract between the members (owners) of the LLC, so a multi-member LLC needs to have one. Although a single-member LLC is not required to have an operating agreement, you should create it as a best practice to prevent others from piercing the corporate veil when you are in a lawsuit. You don’t need to file this agreement to the Secretary of State. It’s an internal document signed by the owners and managers. If your LLC has only one person, then sign your name on it.

The operating agreement contains your personal information such as your name and address. You don’t need to file it anywhere, so your company is still anonymous to outsiders.

You can download a comprehensive template of operating agreement and make custom changes in your Word processor.

Content of operating agreement usually includes:

- Company Name, Address, Registered Agent information: These should be the same as the information on the Article of Organization.

- Purpose of the Company: For an e-commerce business, you can say that your company will take advantage of the Internet to sell physical products online.

- Organization: When the company is created, who the members are, and the ownership percentage of each member. 100% for single-member LLC.

- Management and Voting: member-managed or manager-managed. How decisions are made (normally via voting) and How votes are calculated. What amount of votes is required to pass a decision. What are the rights and obligations of the members and managers.

- Capital Contributions: which members have given money to start the LLC and how additional money will be raised by members

- Distributions: how the company’s profits and losses are shared among members. When a member can withdraw profit (For a single-member LLC, it’s best to indicate that the member can withdraw at any time as the member see fit. )

- Membership Changes: the process for adding or removing members. (For foreign-owned single-member LLCs, you don’t want to add more members so as to avoid tax in the USA). How to transfer ownership if the member dies. (You probably want to transfer the ownership to one of your family members in case you die.).

- Dissolution: Under What circumstances the company may be or must be dissolved. (For example, unable to make profits)

- Requirements for periodic meetings: For example, you can require the company to hold a meeting at least once a year.

- Tax Treatment: Disregarded Entity or S Corporation. For foreign-owned single-member LLCs, choose disregarded entity.

Notes

- Don’t stipulate a forced distribution in your operating agreement. You can take distributions whenever you want, but don’t say in the operating agreement that the LLC member must take a distribution every month or every year.

- Your operating agreement can be updated at any time.

- Every member and manager (if there is any) of the LLC needs to sign the operating agreement. If you create an electronic operating agreement, you can use DocuSign to add a digital signature.

- There is no requirement that the operating agreement is notarized.

Step 6: Get a Tax ID (EIN & ITIN) From IRS

- EIN (Employer Identification Number) is the tax ID number for your LLC. EIN is also known as FEIN (Federal EIN).

- ITIN (Individual Taxpayer Identification Number) is a tax ID for you as an individual.

Single-member LLC is not required by the state to have EIN. However, EIN is required if you need to do one of the following things.

- Hire employees for the LLC

- Elect the LLC to be taxed as Corp

- Open a business bank account for the LLC

- Create an Amazon FBA seller business account

- File form 5472 to the IRS every year

I recommend getting an EIN as soon as you can. Even if your LLC doesn’t have any business activity, you still need to file form 5472 to the IRS. Getting an EIN could be a very slow process during COVID. Sometimes it can take 2 months, especially in February, March, and April, because it’s the tax season.

EIN Fast-Track Service

For non-USA residents, it can take longer as non-USA residents don’t have SSN/ITIN, so they can’t complete the EIN order online. The fastest way to obtain EIN is using an EIN fast-track service on Fiverr. Again, I use the same Fiverr seller. I spent $150 for this service and get my EIN the next business day. You can also choose to pay $100 and get your EIN in 7 days. This fiverr seller lives near the IRS, so she can get it quickly done. You will receive the IRS letter

You will need to prepare the SS-4 form before you contact this Fiverr seller. Download the SS-4 form, then use Sejda PDF editor to fill it out. Next, print the form because the signature needs to be written by hand. Then scan the form and fax it to the IRS. When you fill out the form, use UPPERCASE LETTERS because it helps the IRS process your form faster. And also bold your text because it will be more readable on print papers.

When you use Sejda PDF editor, don’t enter your text directly in the interactive field. Instead, you should click the Text button to add text to the form. Then move the text to the interactive field. This allows you to bold the text in the process.

Here is how to fill out form SS-4.

- Legal name of entity: Enter the name of your LLC in the exact same way it’s written in your Articles of Organization.

- ignore

- ignore

- Enter your mailing address in the U.S. that is assigned by Anytime Mailbox.

- ignore

- County and state where principal business is located: Enter your home city and home country like

LONDON, UNITED KINGDOM. - Name of responsible party: Enter your full legal name. It’s the person in control of your LLC and it must be an individual SSN, ITIN, or EIN: Enter

FOREIGN CITIZEN. - Is this application for a limited liability company:

YesThe number of LLC members:1was the LLC organized in the United States:Yes - Type of entity: Other (specify)

FORM 5472 FOREIGN-OWNED U.S. DISREGARDED ENTITYState:WYOMINGForeign Country: Don’t enter anything here. - Reason for applying: Started new business (specify type) If you are e-commerce seller, then enter

E-COMMERCE, if your LLC is holding company, then enterGENERAL BUSINESS - Date business started: Enter the date your LLC is formed as indicated by the Article of Organization.

- Closing month of accounting year:

DECEMBER - Highest number of employees expected in the next 12 months: Agricultural

0Household0Other0. - ignore

- ignore

- the principal activity of your business: Choose your industry. For e-commerce, you can enter

Other ecommerceIf your LLC is a holding company, enter OtherGENERAL BUSINESS (HOLDING COMPANY). - principal line of merchandise sold: For e-commerce sellers, enter

ONLINE SALES. If your LLC is a holding company, enterGENERAL ACTIVITY (HOLDING COMPANY) - Has the applicant entity shown on line 1 ever applied for and received an EIN?

No.

- Name and title (type or print clearly): Your legal name, MEMBER such as

JAMES GREEN, MEMBER - Applicant’s telephone number (include area code): It can be a U.S number or your own country number.

- Applicant’s fax number (include area code): You must enter your fax number in order to receive the IRS EIN letter.

Then print this form and write your signature on it. Also write the date.

You should not use a nominee to apply for EIN and hide your own identity. Enter your real legal name in the SS-4 form. The applicant’s personal information on this form is not going to be a public record.

Do it Yourself

If you think the EIN fast-tracking service is expensive for you and you can wait a long time, then you can use fax to obtain EIN. Simply fax form SS-4 and your Article of Organization to the IRS, the fax number of which are as follows.

- Fax: (855) 215-1627 (within the U.S.)

- Fax: (304) 707-9471 (outside the U.S.)

If you don’t have a fax machine, you can use a cheap online fax service to send and receive fax. At fax.plus website, choose a fax number located in Wyoming and fax to the (855) 215-1627 IRS number. Wait at least 3 weeks for receiving the EIN from IRS at your fax number.

fax.plus offers a free plan, but you will need a dedicated fax number to receive EIN from IRS, so you should at least upgrade to the Basic plan ($4.99/month) to obtain a dedicated fax number. Enter your fax number on the SS-4 form.

Using an online fax service is essential to your business. You will need to use it in other situations as well. For example, you will need to use fax to file form 5472 every year with IRS.

EIN Letter

No matter which above methods you choose, you will get IRS EIN confirmation letter (CP 575 letter) at your U.S. mailing address. This letter comes from the IRS EIN Operation in Cincinnati, Ohio. In your Anytime Mailbox account, send a scan request of this letter. Once the scan is complete, you need to save this letter in your permanet records. Anytime Mailbox allows you to save this scanned document in PDF format on your computer. This letter can also be used as an address proof, if you are required to show address proof in the future.

On the envelope, there will be a notice “official business penalty for private use, $300”. Don’t worry, you don’t need to pay $300 penalty fee. This notice is for anyone who use “stamp-free” envelopes for personal mailing. You will also see on the envelope that IRS identified you as the sole member (sole MBR) of your LLC.

EIN is valid as long as your LLC still exists. If you close your LLC, then you need to inform the IRS to cancel the EIN. This is important to prevent identity theft.

Note: If the responsible party of your LLC changes, you must report this change in 60 days by filing form 8822-B.

ITIN

ITIN is a tax processing number only available for certain nonresident and resident aliens, their spouses, and dependents who cannot get a Social Security Number (SSN). So ITIN is like a social security number (SSN) for non-resident and resident aliens.

ITIN isn’t necessarily for everyone but is recommended for many. Because online payment processors like Paypal, Stripe, Shopify Payments, etc require you to have ITIN in order to open a business account with them. If you need to use Paypal to send or receive money for your business, you should obtain an ITIN number. If other online payment processors require SSN, you can enter your ITIN in the SSN text field.

It also takes very long (about 4 months) to get an ITIN during COVID, so you need to do it as soon as possible.

Some folks might be wondering if having an ITIN makes you taxable in the United States. Just because you have ITIN doesn’t mean you have to pay tax to IRS. Only when you have effected connected income (ECI), you need to pay taxes in the USA.

- To get an ITIN, you need to fill out the form W-7.

- Once you get an ITIN, you should use it. If you don’t use it for 3 consecutive years, it will expire. If you file tax return every year, your ITIN doesn’t expire.

- After you have a Business Paypal account, you can connect it with your Mercury, Brex, or other business bank account.

- If Paypal sends you a 1099K form, then you need to indicate in this form that you are not doing business in the United States, so you won’t pay tax.

- Although you need to send your real information to the IRS, this information is not published for the public.

You need to save the IRS letter. Some banks might require you to upload this IRS letter. If you lost this letter, request a copy of the letter from the IRS.

Step 7: Business Bank Account & Business Credit/Debit Card

There are several important steps you need to take after forming your LLC to ensure your new business is protected and compliant. One of them is to open a dedicated business bank account and get a business credit/debit card.

With a business bank account, you can

- Keep your business and personal finance separate and protect your corporate veil in a lawsuit.

- Build a long-term banking relationship and gain access to business credit card perks, such as cashback and travel rewards. If you run an e-commerce business, the cashback will save a lot of your expenses when you source products.

- Have the ability to process e-commerce transactions, if you run your own online store.

It’s a hassle to open a bank account at a physical bank in the USA because you need to go to the United States. While you can authorize another person to open a bank account for you, it’s not safe, since that person will have control of your bank account.

It’s much easier for you to use an FDIC-insured online bank to open a bank account for your company, so don’t need to go to the United States. Some of the online banks also have integration with online e-commerce platforms, so your online business will become easier. The following is a list of online banks. The difficulty of opening account is indicated in the parentheses.

- Mercury bank (easy)

- Brex (intermediate)

- BankNovo (hard)

- relayfi

You need an EIN number in order to open a bank account for your LLC.

Mercury Features

- Virtual and physical debit cards. The virtual debit card allows you to start your business quickly without having to wait several weeks (sometimes months) for the physical debit card to arrive in your hands.

- Free account opening. No minimum deposit requirement. No monthly fees. No overdraft fee.

- Free ACH transfer

- Free domestic and international wire transfer.

- Sending & receiving checks are also free.

- The mobile app allows you to manage business banking on the go.

- API to accept and send payments.

- Integrate with Paypal, Stripe, Quickbooks accounting, Amazon, Shopify, and Zapier.

- Use Time-based One Time Passwords for two-factor authentication to secure your account.

- Database encryption for additional security.

- FDIC-insured.

Mercury Applicant Requirements

- Your company must be registered in the U.S.

- Federal EIN

- Article of Organization

- A picture of your government-issued ID (passport, national ID card, or driver’s license).

You can use the Mercury virtual debit card instantly after opening the account. If you need a physical card, you can use a mail forwarding service like Anytime Mailbox to deliver the card to your home.

Go to Mercury website to open an account. The process is very simple. I just want to tell you that in step 2 of adding company profiles, you need to add your company mailing address, not your personal home address.

In the onboarding process, Mercury tells you to upload your passport. If you don’t have a passport, you can upload your national ID card or driver’s license. Later Mercury will verify your identity with withpersona.com.

Brex Features

- Free account opening. No minimum deposit requirement. No monthly fees. No overdraft fee.

- Free ACH transfer

- Free domestic and international wire transfer.

- Sending & receiving checks are also free.

- Business credit card with locking function. It’s a credit card that can build your business credit but you spend like a debit card. You can spend as much as your Brex cash account balance.

- Issue unlimited virtual cards to your team and set a spending limit.

- The mobile app allows you to manage business banking on the go.

- FDIC coverage up to $250,000.

- Easily invest some or all of your account balance in money market funds.

- integrates with accounting tools (Quickbooks, Xero, Netsuite, etc)

- The mobile app allows you to manage business banking on the go.

Brex Applicant Requirements

- Your company must be registered in the U.S.

- Federal EIN

- Article of Organization

- A picture of your government-issued ID (passport, national ID card, or driver’s license).

- Provide or have plans to provide services and products to US customers

- U.S. billing address. Use Anytime Mailbox to get a physical address in the U.S.

Brex: It’s recommended that you only apply for Brex bank account after your business has enough cash flow going on. If Brex finds that you don’t have cash flowing in your bank account, they are likely to close your account. One way of preventing this from happening is to fund your company after you get a Brex bank account. If you can fund $10,000 to your company, then send $1000 every other day to the Brex bank account. Do this 10 times, and your Brex account will have $10,000 in balance.

Brex can also close your account if you don’t have a physical operating address in the United States. By default, if you use your registered agent’s address, they will not forward mail to you. They only use this address for correspondence with the state.

BankNovo Features

- Free account opening. No minimum deposit requirement. No monthly fees. No overdraft fee.

- Free ACH transfer

- Free domestic and international wire transfer.

- Sending & receiving checks are also free.

- A virtual card for immediate and secure spending. Novo debit card allows you to withdraw money anywhere and get refunded on any ATM fees

- The mobile app allows you to manage business banking on the go.

- FDIC-insured

- Integration with Shopify, Strip, Wise, Zapier, Quickbooks, Slack,

- The mobile app allows you to manage business banking on the go.

BankNovo Applicant Requirements

- Your company must be registered in the U.S.

- Federal EIN

- Certified Article of Organization

- Signed Operating Agreement

- A picture of your government-issued ID (passport, national ID card, or driver’s license).

- social security number (SSN) or ITIN

- U.S. billing address. Use Anytime Mailbox to get a physical address in the U.S. The address should be able to be found in the USPS database.

- a US cell phone number (not a virtual number).

Step 8: Organize All Your Company Documents

Stores these documents in one place so you can easily find them when you need to.

- Article of Organization

- Statement of the Organizer

- Record Book

- Operating Agreement

- Company Seal (optional)

- EIN assignment letter from the IRS

- Membership certificate (Ownership Certificate)

- Minutes

- Resolutions (including banking resolutions).

A corporate kit is a common way to organize and store your company documents. You can buy a corporate kit online or create your own corporate kit.

Step 9: Get a USA phone number

Go to textnow.com to get a free USA phone number. You need to use a VPN, so your computer will have a United States IP address, then you will be able to get a USA phone number.

Step 10: Capitalize Your Company

This means you need to fund your company so it can pay for expenses. You need to put enough money into your company so it’s not thinly capitalized.

It’s very simple to capitalize your company: You transfer some money from your personal bank account to your new business bank account. This type of money is also called a capital contribution. For a single-member LLC, a few hundred dollars might be plenty. You should record capital contributions in your LLC’s books.

You can also contribute an inventory to the LLC if you already sourced products and stored them in Amazon warehouse. You need to determine the value of your existing inventory. Typically it’s how much you paid to your suppliers.

Other forms of capital contribution include your computer, printer, office equipment, car etc. Anything that the business will use can be contributed.

Going forward, it’s important always to keep enough capital in your business to meet your ongoing expenses. This is for operating the business and also prevents someone else from piercing the corporate veil if you are in a lawsuit.

File Annual Report to the State

An annual report needs to be filed to the Secretary of State once a year. The content of the report is very simple. Typically it includes:

- The principal business (head office) address of the company, which can be found in the Articles of Organization.

- The names and addresses of the managers of the business (directors and officers in a corporation, members and managers in an LLC).

- Important identification numbers for your business.

- The purpose of your business.

- Authorized signatories and registered agents.

The annual report filing fee in Wyoming is $60. The due date for Wyoming LLCs is on the first day of the anniversary month of formation.

- For example, if your LLC was formed on May 15, then your Annual Report is due May 1 of each year, so you need to file an annual report in April each year. If you fail to file the annual report after 60 days (July 1), your LLC will be dissolved.

Since 2021, you can file annual report online: https://wyobiz.wyo.gov/Business/AnnualReport.aspx. Watch the video instructions below.

Note that the information in the annual report will be public. If you don’t want to disclose your information to the public, then you should use a nominee service to file the annual report. (Wyoming doesn’t require LLC to disclose the name and address of LLC members in the annual report, so you can file it by yourself online without worrying about disclosing your personal information to the public.)

You need a VISA or MasterCard Credit Card/Debit Card in order to pay the annual report fee.

After filing the annual report online, you can download the annual report in PDF format. The PDF file might tell you to return both the form and worksheet to the Secretary of State. Just ignore it. You have already submitted the form and worksheet when filing the annual report online.

You also need to hold an annual meeting for your LLC before May 1 each year. For single-member LLC owners, you can hold the annual meeting at your home and just record the meeting in your company’s books.

File Form 5472 to the IRS

A foreign-owned single-member LLC might have an obligation to file form 5472 to the IRS every year. It’s the only form you have to file with the IRS every year. You input reportable transactions between you and your company in this form. If your company doesn’t have reportable transactions in a calendar year, then you don’t need to file this form. Most companies have reportable transactions.

The due date is April 15th. You can request an extension of 6 months, to Oct 15th. But you should always file the form as soon as possible to avoid problems. Filing this form doesn’t mean you have tax to pay. As we said before, if your business doesn’t have effectively connected income in the US, you don’t need to pay tax.

For details on how to file this form, please read the following article:

Check Your LLC Info

You can go to the Secretary of State’s website to find the info on your LLC, so you can know if it’s correct.

For example, if your form an LLC in Wyoming, then go to this address: https://wyobiz.wyo.gov/Business/FilingSearch.aspx and enter the official name of your LLC in the filing name text field. Once it found an entry, click the result and it will show you the info.

- Filing ID: the identification number assigned to your LLC by the Secretary of State’s Office. You can also find this filing ID in the Articles of Organization (Original ID). Note that this is NOT your EIN (Employer Identification Number).

- Status: Whether your LLC is active or inactive (dissolved).

- Standing: Whether your LLC has good standing status (file annual report, maintain a registered agent.)

- Principal Office

- Mailing Address

- Registered Agent information

- LLC organizer: If you formed an anonymous LLC in Wyoming, then this will show the name of your registered agent.

The above information is public. Anyone can look up your LLC info on the Secretary of State’s website. After filing annual report, you can check your LLC info. Under the History section, you can find the annual report of your LLC.

Certificates of Good Standing

You can obtain an electron certificate of good standing for free from the Secretary of State’s website: https://wyobiz.wyo.gov/Business/ViewCertificate.aspx. All you need to do is enter your LLC filing ID.