The development of the Internet creates a new kind of economy around the world: the gig economy. It’s not uncommon that a non-US resident/citizen gets paid by a US company over the Internet. And the question arises: Do I need to pay tax to the US government (IRS) as a nonresident alien? What are my duties when it comes to staying in tax compliance with the IRS (Internal Revenue Service)?

There are so many confusions around this topic because you might get different answers from different tax advisors. This happened to me. I got complete contradictory answers from different tax advisors and it made me very nervous. It will be much easier if we can get direct answers from the IRS. However, you will also get confused when you browse through the IRS website.

How can you sort through the confusion and get to the correct answer?

- Use your common sense

- Join groups/forums and know how other people handle the tax.

Thinking back about my experience, I suspect that one of the tax advisors was trying to lure me to buy her another service so she gave me a different answer.

This article aims to clear the confusion.

Nonresident Alien & Resident Alien

A nonresident alien is:

- not U.S. citizen (people who hold U.S. passports)

- not U.S green card holder (also known as lawful permanent resident)

- not living in the United States

There are also resident aliens. A resident alien is not U.S. citizen (people who hold U.S. passports),

- But lives in the United States for more than 30 days in a calendar year and more than 183 days for 3 year period (substantial presence test)

- or is a green card holder

If you are a resident alien, you need to pay taxes to the IRS on your worldwide income.

In the following texts, we only focus on nonresident aliens. This article is divided into two parts:

- The first part is for people who are doing work as a person (no company) outside of the United States.

- The second part is for people who is outside of the United States but has or plans to set up a company in the United States (single-member LLC)

Terms & Phrases in Tax

There might be some terms or phrases that you are not clear about its meaning. The following is a list of some common ones.

- income subject to U.S. tax = taxable income = you need to pay tax to IRS on this income

- tax year: your tax year is the calendar year. A calendar year is 12 consecutive months ending on December 31.

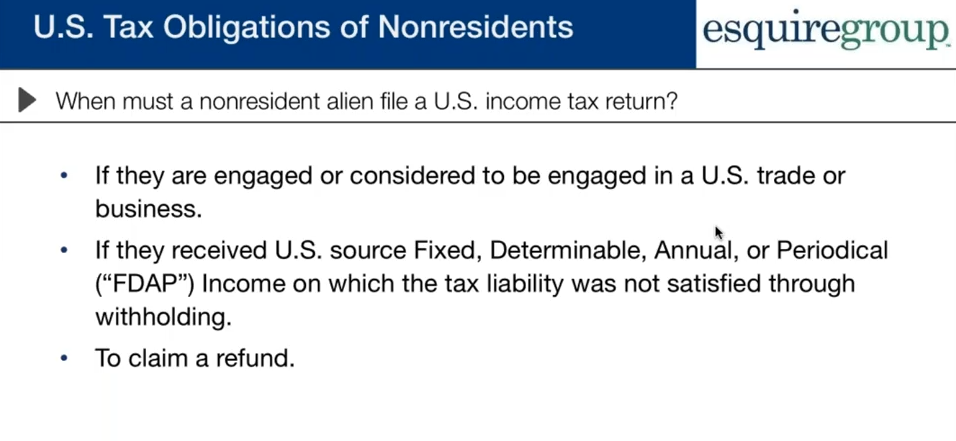

When do nonresident aliens need to pay tax to the IRS?

Nonresident aliens are taxed only

- on their income from sources within the United States (U.S. source income),

- and on certain income connected with the conduct of a trade or business in the United States. (ECI income)

U.S. Source Income

What is U.S. source income?

- If you live outside of the U.S. and did some work for a U.S. company, then the compensation is NOT U.S. source income.

- If you have a U.S. bank account, and it earns interest every month, then the interests are U.S. source income.

- In most cases, dividend income received from U.S. corporations is U.S. source income

The place or manner of payment is immaterial in determining the source of the income.

- If the payment is sent to your U.S. bank account, it’s not U.S. source income.

- When your savings in the bank account generate interest, the interest is U.S. source income, and you only pay tax for the interest.

Note: Not all items of U.S. source income are taxable. Please read IRS publication 519, chapter 3 for details.

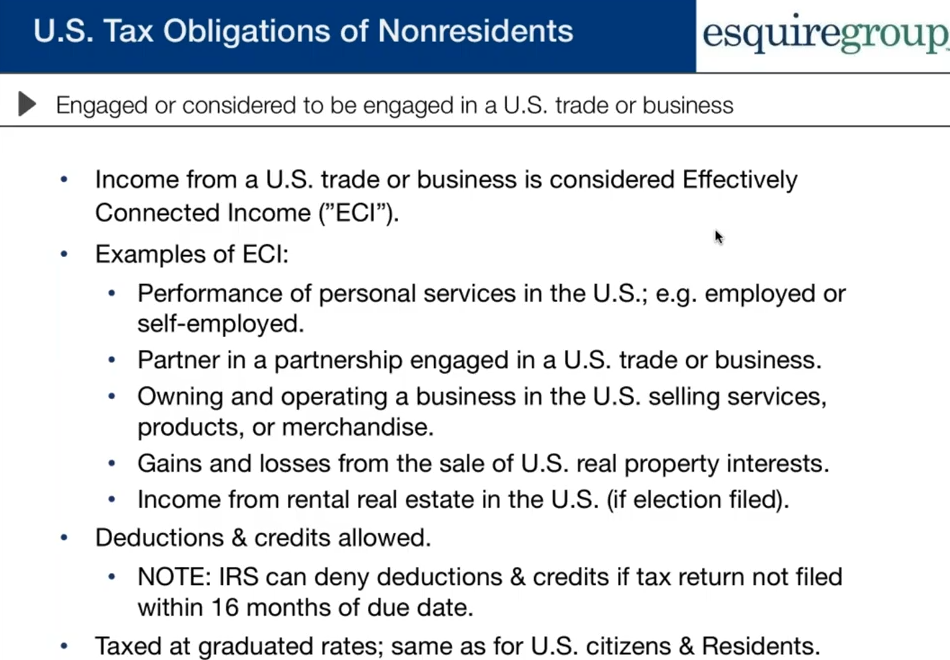

Effectively Connected Income (ECI)

Determine if the income you receive during the tax year is effectively connected with a U.S. trade or business.

Generally, you must be engaged in a trade or business during the tax year to be able to treat income received in that year as effectively connected with that trade or business. Whether you are engaged in a trade or business in the United States depends on the nature of your activities.

- If you perform personal services in the United States at any time during the tax year, you usually are considered engaged in a trade or business in the United States.

- Business operations. If you own and operate a business in the United States selling services, products, or merchandise, you are, with certain exceptions, engaged in a trade or business in the United States.

- If your only U.S. business activity is trading in stocks, securities, or commodities (including hedging transactions) through a U.S. resident broker or other agent, you are not engaged in a trade or business in the United States.

If you are engaged in a U.S. trade or business, all income, gain, or loss for the tax year that you get from sources within the United States (other than certain investment income) is treated as effectively connected income.

Effectively Connected Income

Part 1

Question: I’m an affiliate marketer and have a website located in the United States. I don’t own the web server. I rent the web server from a web hosting service in the Unite States. Do I need to pay tax to IRS? Is the IRS able to find out that I rent web servers in the US? How does the IRS categorize affiliate commissions?

- You don’t need to pay tax. If you use a private server that is only for you, then you might need to pay tax.

Question: What’s the purpose of W-8BEN? Does it make you tax-free? I submitted form W-8BEN to an affiliate network. Does it mean that payments made from this particular affiliate network are tax-free?

- The From W-8BEN itself tells you that this form is only for nonresident aliens and your income is not effectively connected income (ECI), and your personal services are performed outside of the United States.

- Affiliate networks won’t withhold 30% of your affiliate commission if you submit W-8BEN. However, The IRS says: “Give Form W-8 BEN to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding. Submit Form W-8 BEN when requested by the withholding agent or payer whether or not you are claiming a reduced rate of, or exemption from, withholding.” At first glance, it appears that your affiliate commission is not taxable. If your affiliate commission is taxable, why affiliate networks don’t withhold the 30%?

- So W-8BEN doesn’t make you tax-free.

- Since W-8BEN tells you that your income is not ECI, then the only situation that you have to pay U.S. tax is when the income is U.S. source income. But W-8BEN also tells you that your personal services are performed outside of the United States, so your income is not U.S. source income. So effectively W-8BEN makes your income tax-free.

- If you have U.S. income, the withholding agent (affiliate network) will give you form 1042-S to fill out.

- If you have Effectively Connected Income, then the withholding agent (affiliate network) will give you form W-8ECI to fill out.

- The affiliate network Rakuten Marketing says: “All US-based publishers are required to select the W-9 form. Publishers from all other countries can select either a W-9 form (effective January 21, 2015) if they are liable for paying taxes in the United States, or a W-8 form if not.”

Question: When do I need to pay tax to the IRS?

- Nonresident aliens are taxed only on their income from sources within the United States and on certain income connected with the conduct of a trade or business in the United States.

- I read IRS publication 519 and from what I read, it seems like that I need to pay tax when I have U.S. source income or effectively connected income. Some tax advisors say that I need to pay tax only when the U.S source income is effectively connected to a trade or business in the United States. What do you think? Can you show me what the Internal Revenue Code says about it?

- Is stock trading a U.S. source income? I trade U.S. stocks, but I don’t pay capital gains tax.

- Is Amazon FBA income a U.S. source income? But it’s not eci?

- Is affiliate commission U.S. source income? Is it ECI income?

Question: If my affiliate commission is taxable, but the affiliate network doesn’t withhold 30% of my commissions, are there any penalties from the IRS?

- If it is taxable, the payer is required to withhold the taxes. If the payer does not withhold taxes on payments to non residents subject to tax/withholding, then the affiliate network is liable for this tax.

- IRS publication 515 says: “As a withholding agent, you are personally liable for any tax required to be withheld. This liability is independent of the tax liability of the foreign person to whom the payment is made. If you fail to withhold and the foreign payee fails to satisfy its U.S. tax liability, then both you and the foreign person are liable

for tax, as well as interest and any applicable penalties.

When do I need to pay tax to the IRS? I read IRS publication 519 and it seems like that I need to pay tax when I have U.S. source income or effectively connected income. Some tax advisors say that I need to pay tax only when the U.S source income is effectively connected to a trade or business in the United States. What do you think? Can you show me what the Internal Revenue Code says about it?

- OK if all income is earned online it is not effectively connected with a US trade or business. See code sections 862 and 864 and 871 if you want.

Is Amazon FBA income a U.S. source income? But it’s not ECI?

- CORRECT

Is affiliate commission U.S. source income? Is it ECI?

- It could be US Source but not subject to US taxation and not effectively connected with a US trade or business.

Question: What is a tax return? Do I need to file a tax return? Are there any fines if you don’t file a tax return?

- As an individual, there is nothing to do. If you want to really protect yourself you can file a Form 1040NR to proactively show the IRS you have no income subject to US taxation. This is not necessary. But if you work with us we do it anyways.If you open an LLC, you need to file a pro forma form 1120 with a Form 5472 attachment. I have a course and also provide this service (James Baker). You also need to renew the LLC with the state each year depending on the state rules.

- You can use the Interactive Tax Assitant to determine whether or not you need to file a tax return.

- Nonresident alien taxpayers should use Form 1040-NR to file tax return. Attach Form 1040-NR Schedules OI, A, and NEC to Form 1040-NR as necessary.

- To file a tax return, you must apply for an individual taxpayer identification number (ITIN). Enter your ITIN wherever an SSN is required on your tax return. See Form W-7 and its instructions on how to apply for ITIN.

- You must report each item of income that is taxable. For nonresident aliens, this includes both income that is effectively connected with a trade or business in the United States (subject to graduated tax rates) and income from U.S. sources that is not effectively connected (subject to a flat 30% tax rate or lower tax treaty rate).

- A tax return is different from information returns such as From 5472.

Question: I have a U.S. bank account. It’s a checking account and I earn interest on this account. Do I need to pay taxes on the interests? According to the IRS website, I need to pay tax on the interests. But my bank tells me that it’s not subject to U.S. tax. It’s confusing.

- YES THE BANK SHOULD WITHHOLD TAXES ON THIS INTEREST, GENERALLY. Portfolio interest however is not subject to US taxation.

- If the bank has a W-8BEN on file for you (they should) then they will withhold any taxes and issue you a FOrm 1042s. There is nothing else you really need to do in this scenario.

- One type of tax-free interest is interest earned on ordinary bank deposits. The US apparently wants to encourage you to keep your money in the US.

Question #2: If you need to pay tax, how do I pay the money?

Question: I live outside of the United States and did some work through fiveer.com for a U.S. company. Is this income subject to U.S. tax?

- No.

Question: Do I need to pay tax if I trade cryptocurrencies on US-based exchanges? Are earnings from cryptocurrency trading the same as capital gains?

- If you are verified as a US Non-Resident it shouldn’t affect you. You don’t have to pay tax on this as far as I know.

Question: What is ITIN? Do I need one?

- You need to have a reason to request ITIN. You can’t just fill out the W-7 form and have no reason to request one. The most common reason is that you have U.S. source income and need to file Form 1040-NR to IRS. If you request ITIN by yourself, you need to send a certified copy of your passport to the IRS along with Form W-7. Or you can apply ITIN with the help from a Certifying Acceptance Agent (CAA).

- Most U.S. banks require you to have ITIN in order to open bank account for nonresident aliens. So if you have ITIN, it will be much easier for you to open a personal bank account in the U.S. Enter your ITIN wherever an SSN is required.

Penalities:

You will not have to pay the penalty if you show that you failed to file on time because of reasonable cause and not because of willful neglect

Holding Company Structure

Question: I need to start two LLCs. One is a holding company for IP protection: patents, trademarks, and copyright. The other LLC is for operating the Amazon FBA e-commerce business. The holding company will be a single-member LLC. I will be the only member. The subsidiary will also be a single-member LLC, the holding company being the only member. Will I need to pay tax? From what I know, the taxability of the subsidiary passes through to the holding company, then it passes through to me (the owner), is it correct?

- NO taxes to pay here. That structure is fine.

Question: Should the holding company and the child company be in the same states, or is it better to separate them into two states like in Wyoming and Delaware?

- I would just use the same state. It doesn’t really matter though.

Question: If I start dropshipping business in the future, should I form another single-member LLC in the USA with the holding company as the member? Or just use the current company?

- You can start with the same company. I think as it scales and becomes self-sustainable, maybe you can move to another company. It doesn’t really matter from a tax perspective. But multiple companies spread out risk.

Question: If the United States starts to collect income tax from foreign Amazon sellers on the basis that they use Amazon warehouse to store inventories, will the holding company be required to pay tax on all of its income, including the income from Dropshipping?

- This would be a good reason for you to own all of the companies directly, instead of the companies owning each other. You mostly need to be concerned with sales taxes for now.

What can Amazon sellers do to avoid paying the tax? Can I take advantage of the holding company structure to pay less tax? Can I reinvest the profit to the USA stock market at the end of every year and pay no tax? Should I form a separate investment company for this purpose?

- You don’t pay US taxes if you use Amazon FBA. If this changes Amazon will start to withhold the taxes themselves. Since they are not withholding the taxes that is great support for us to know that this income is not subject to US taxation.

Am I required to prepare an annual audit of financial statements for the holding company or the subsidiaries? Will the IRS perform audit on my company?

- You do not need to do any Audits. You should do standard bookkeeping. The IRS generally performs extremely few audits.

Question: I need to file an annual report every year. Is the annual report a public record that anyone can find online? Can someone pay the secretary of state and request the information in my annual report? Is it safe to use a nominee to file annual report? Do I have to include my name in the annual report?

- Yes, this is public. Depending on the state the ownership can be private. But all companies can be searched.

Question: Should I form the holding company in New Mexico and the subsidiary in Wyoming for better anonymity? Because New Mexico doesn’t require filing annual report.

- It is up to you here. I register 90% of my client companies in Wyoming.

Question: How do I file form 5472 with a holding company and the subsidiary company? Do I need to file this form for each company?

- Yes, you need to file for each LLC that has reportable transactions.

Question: I have another separate LLC formed this year. It doesn’t have any business activity yet. Not even have a business bank account set up yet. Do I need to file form 5472 for this LLC?

- Technically paying to open the LLC is a reportable transaction. But whether or not you file is up to you. In the past, the IRS has not been diligent in checking on these filings, at all.

Question: I need to start the two companies as soon as possible, when can I set up the child company once the holding company is established? Do I need an EIN in the holding company in order to set up the child company?

- Yes, the holding company will need EIN to form subsidiaries.

Question: LLC can be member-manged or manager-managed. If the manager is a non-USA person, so the manager doesn’t need to pay USA tax on the salary, is it correct? Does the LLC need to pay payroll tax? What’s your recommendation? Member-managed or manager-managed?

- If you are the member and you are running the company it is member-managed. If the company is owned by someone else and you are running it, it is manager managed.

Question: Can you give me a list of things that I should not do in order to avoid paying tax in the USA? Can I use a mail forwarding service in the United States? Can I travel to the United States?

- You can do either of these. You just should not conduct business in the US or have a private warehouse or office or actual employees in the US. Contractors are fine.

Do you think if my banking information in the US is going to be shared with the Chinese government under CRS or FATCA? Will the IRS share my tax information with the Chinese government? USA and China have tax treaty.

- I find this very unlikely. But I really don’t know.

Employment

Question: Is my LLC allowed to hire non-U.S workers, specifically nonresident aliens like myself who never travel into the United States? Some folks say that it’s illegal. The USCIS will punish you for doing this? Is there any employment tax?

- Of course, you can hire and pay nonresidents. No employment tax issues at all.

- There are 3 types of individuals in terms of IRS: U.S. citizen, U.S. resident alien, nonresident alien.

- It is against federal law to hire illegal aliens. What is illegal alien? Undocumented immigrants, also called illegal aliens, are foreign-born people who do not possess a valid visa or other immigration documentation, because they entered the U.S. without inspection, stayed longer than their temporary visa permitted, or otherwise violated the terms under which they were admitted. A more easy-to-understand word is “illegal immigrant”.

- It is legal to hire resident alien and nonresident alien.

- If you hire a nonresident alien, you must give form W-4 to the nonresident alien.

Question: Does the nonresident alien employee have to pay tax to IRS?

- Just like resident aliens, nonresident aliens are generally subject to social security, medicare taxes and FUTA. But if the employer is also a non-resident alien, then no tax to pay at all.

What if I hire them as independent contractors instead of employees?

- Correct that is what you would do.

Employees vs Independent personal services

- You can hire nonresident aliens as an employee, you can also hire them as an independent contractor. You might need to withhold taxes even if they are not your employees.

Question: Is the LLC required to withhold 30% of payment to nonresident alien independent contractors?

- No.

- If you are a nonresident alien and also the owner of LLC, when you hire nonresident alien independent contractor. Please call the IRS business and speacility tax line at 1-800-829-4933 or ask your tax professional.

Question: How to tell if the nonresident alien is an employee or independent contractor?

Further Reading:

- IRS publication 519: U.S. Tax Guide for Aliens

- IRS publication 515: Withholding of Tax on Nonresident Aliens and Foreign Entities

- Internal Revenue Code

- Deloitte: U.S. Taxation of Foreign Nationals by the U.S.

- Hiring People Who Live in the U.S. But Are Not U.S. Citizens

- US taxes guide for non-US affiliate marketers

- International Affiliate Commissions vs. International Taxes

- How to live tax-free as an affiliate marketer in 5 steps

- IRS Help with Tax Questions – International Taxpayers

- Interactive Tax Assistant (ITA)